inheritance tax rate indiana

By the appropriate tax rate. Inheritance tax applies to assets after they are passed on to a persons heirs.

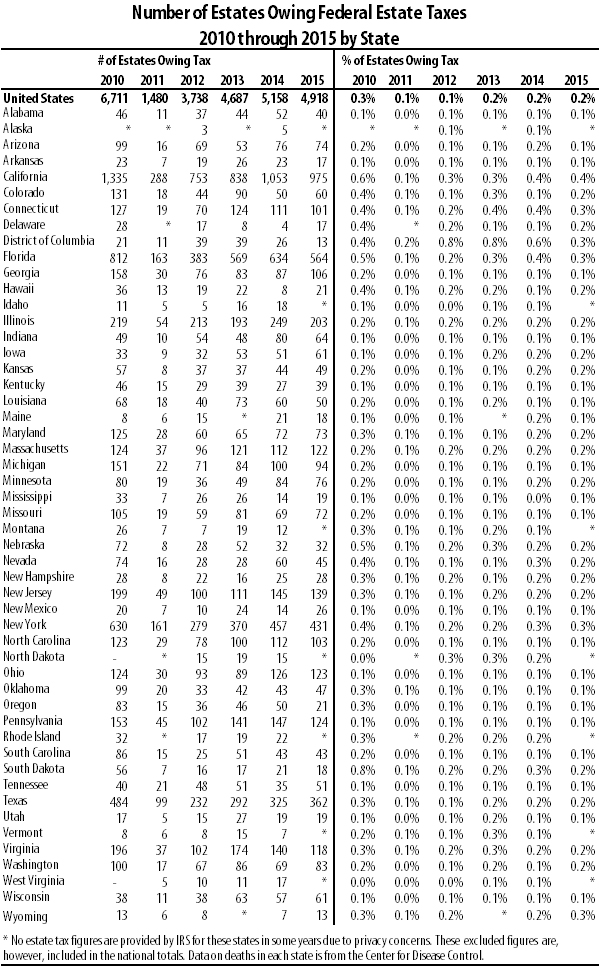

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

There is also a tax called the inheritance tax.

. Whereas the estate of the deceased is liable for the. So no inheritance tax returns Form IH-6 for Indiana residents for Form IH-12 for non-residents have to be prepared or filed. The Indiana law imposed an inheritance tax at progressive rates upon lineal and collateral relatives as well as strangers.

In 2021 the credit will be 90 and the tax phases out completely. No estate tax or inheritance tax. In Maryland the tax is only levied if the estates total value is more than 30000.

Class A Net Taxable Value of Property Interests Transferred Inheritance Tax 25000 or less 1 of net. The inheritance tax rates are listed in the following tables. Inheritance tax usually applies when.

However be sure you remember to file the following. For most decedents estates there was no or very little Indiana inheritance tax. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be.

The act was amended in 1915 1917and 1919. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. In 2021 the credit will be 90 and the tax phases out completely after December 31 2021.

Ohios estate tax was repealed effective January 1 2013. State inheritance tax rates range from 1 up to 16. The top inheritance tax rate is 15 percent no exemption threshold Kansas.

No tax has to be paid. Indiana does not levy a gift tax. In addition no Consents to Transfer Form IH-14.

Indiana has a three class inheritance tax system and the exemptions and tax rates. Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. No tax has to be paid.

The Probate Process In Indiana. The Iowa tax only applies to inheritances resulting from estates worth more than 25000. Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary.

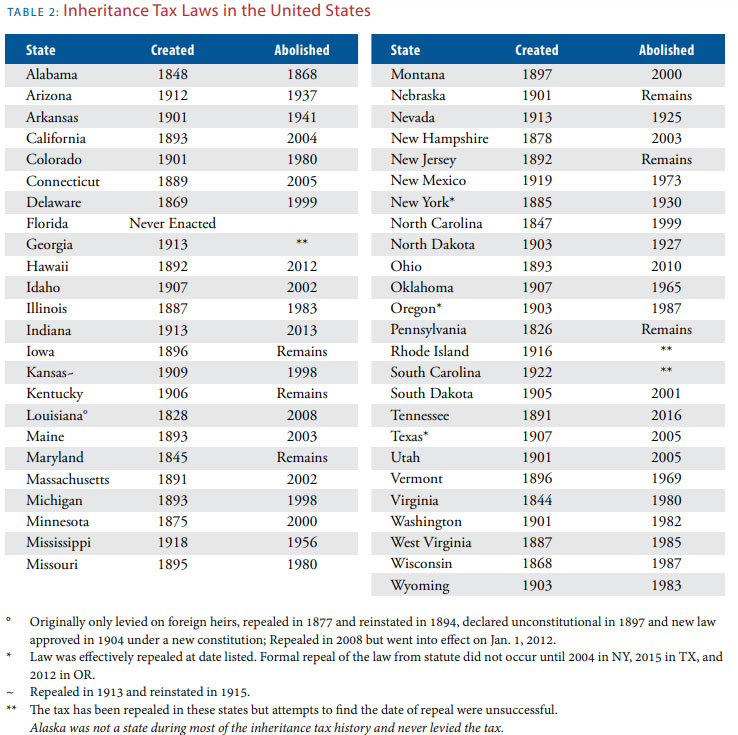

Both state estate taxes and state inheritance taxes have been on the chopping block lately. Tax rates can change from one year to the next. In 2021 the credit will be 90 and the tax phases out completely.

Up to 25 cash back Each beneficiary except those who are entirely exempt from the tax must pay tax on the amount he or she inherited minus the exempt amount. Inheritance tax was repealed for individuals dying after December 31 2012. There is no inheritance tax in Indiana either.

In additon no Consents to Transfer Form. In 2021 the credit will be 90 and the tax phases out completely. Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary.

The federal government has a gift tax though with a yearly exemption of 15000 per recipient. However the inheritance tax was an issue for those transferring large amounts of capital. Anyone who gets more than that has to pay a tax rate of up to 40 percent on the excess.

No estate tax or inheritance tax. Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary.

Indiana Lawmakers Could Cut Taxes During 2022 Legislative Session

Dor Indiana Department Of Revenue

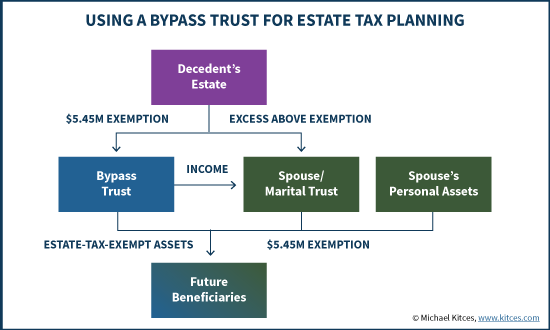

Distributable Net Income Tax Rules For Bypass Trusts

How To Transfer Property In Indiana Pdf Free Download

Adler Estate Law A Legal Blog Written By Indiana Lawyer Lisa M Adler

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

Death And Taxes Nebraska S Inheritance Tax

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

State By State Estate And Inheritance Tax Rates Everplans

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

State Death Tax Hikes Loom Where Not To Die In 2021

How Do State And Local Individual Income Taxes Work Tax Policy Center

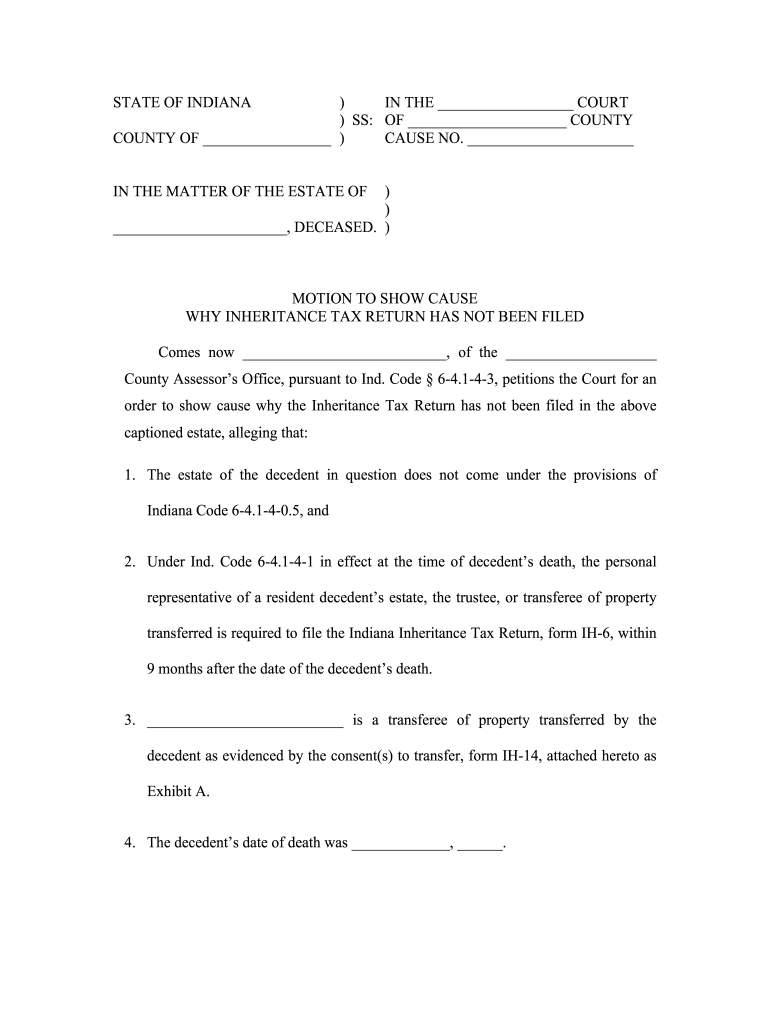

Fillable Online Motion To Show Cause Fillable Form Indiana Fax Email Print Pdffiller

Estate Taxes And Inheritance Taxes In Europe Tax Foundation

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

How Racial And Ethnic Biases Are Baked Into The U S Tax System